All Categories

Featured

Table of Contents

- – Value Private Placements For Accredited Investors

- – Recommended Accredited Investor Wealth-buildin...

- – High-Performance High Yield Investment Opport...

- – High-Quality Accredited Investor Passive Inco...

- – World-Class Exclusive Investment Platforms F...

- – Professional Accredited Investor Secured Inv...

- – Innovative Accredited Investor Real Estate D...

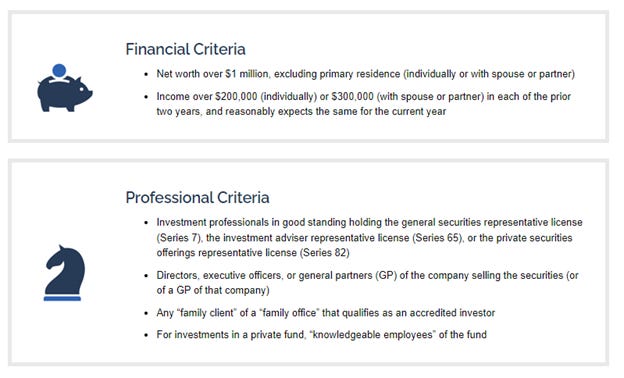

The policies for accredited financiers vary amongst territories. In the U.S, the meaning of a recognized capitalist is presented by the SEC in Rule 501 of Regulation D. To be a recognized capitalist, an individual must have an annual income exceeding $200,000 ($300,000 for joint income) for the last two years with the assumption of making the same or a higher income in the current year.

This amount can not consist of a main house., executive officers, or supervisors of a company that is issuing unregistered protections.

Value Private Placements For Accredited Investors

If an entity is composed of equity owners that are accredited financiers, the entity itself is an accredited capitalist. An organization can not be created with the sole objective of acquiring details safeties. An individual can qualify as an approved capitalist by showing enough education or work experience in the economic industry

Individuals who wish to be approved capitalists don't apply to the SEC for the classification. Instead, it is the responsibility of the firm providing a personal positioning to see to it that every one of those come close to are recognized financiers. Individuals or events who desire to be approved capitalists can come close to the company of the unregistered protections.

Expect there is an individual whose income was $150,000 for the last three years. They reported a key house worth of $1 million (with a home loan of $200,000), a car worth $100,000 (with a superior funding of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Net worth is calculated as properties minus liabilities. This person's total assets is precisely $1 million. This entails an estimation of their assets (various other than their key house) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equating to $50,000. Considering that they fulfill the web well worth requirement, they qualify to be a recognized financier.

Recommended Accredited Investor Wealth-building Opportunities

There are a few less typical credentials, such as managing a depend on with greater than $5 million in assets. Under federal safety and securities regulations, just those that are approved financiers might take part in particular protections offerings. These may include shares in exclusive placements, structured items, and exclusive equity or hedge funds, among others.

The regulators desire to be particular that participants in these highly dangerous and complex financial investments can fend for themselves and evaluate the risks in the lack of federal government protection. The recognized financier regulations are made to shield possible investors with limited financial expertise from high-risk ventures and losses they might be unwell equipped to endure.

Accredited investors fulfill qualifications and specialist criteria to access special financial investment opportunities. Designated by the United State Stocks and Exchange Payment (SEC), they gain entry to high-return alternatives such as hedge funds, equity capital, and personal equity. These financial investments bypass full SEC enrollment however lug greater risks. Accredited investors have to satisfy revenue and web worth demands, unlike non-accredited people, and can spend without constraints.

High-Performance High Yield Investment Opportunities For Accredited Investors with Maximum Gains

Some essential modifications made in 2020 by the SEC consist of:. Consisting of the Series 7 Series 65, and Series 82 licenses or various other qualifications that show monetary experience. This modification recognizes that these entity types are commonly made use of for making financial investments. This change acknowledges the experience that these employees establish.

These amendments expand the recognized financier swimming pool by roughly 64 million Americans. This larger access supplies a lot more opportunities for investors, yet also boosts possible threats as less financially innovative, investors can participate.

One significant advantage is the possibility to invest in placements and hedge funds. These investment options are exclusive to recognized investors and establishments that qualify as a recognized, per SEC laws. Exclusive placements make it possible for business to protect funds without navigating the IPO procedure and governing documents needed for offerings. This gives recognized financiers the chance to purchase emerging business at a stage before they consider going public.

High-Quality Accredited Investor Passive Income Programs

They are deemed investments and come only, to certified customers. Along with known business, certified financiers can choose to purchase startups and promising ventures. This offers them income tax return and the chance to get in at an earlier stage and potentially enjoy benefits if the firm thrives.

For capitalists open to the threats involved, backing startups can lead to gains (accredited investor opportunities). Many of today's technology business such as Facebook, Uber and Airbnb came from as early-stage startups sustained by certified angel capitalists. Sophisticated capitalists have the chance to explore investment choices that might generate more earnings than what public markets provide

World-Class Exclusive Investment Platforms For Accredited Investors for Accredited Investor Opportunities

Returns are not ensured, diversity and profile improvement alternatives are expanded for capitalists. By diversifying their profiles with these increased investment opportunities certified financiers can enhance their approaches and possibly achieve exceptional lasting returns with correct risk monitoring. Skilled financiers usually come across financial investment choices that may not be quickly offered to the basic capitalist.

Investment options and securities offered to approved financiers usually include higher threats. For example, personal equity, venture funding and bush funds commonly concentrate on buying assets that bring threat however can be sold off easily for the opportunity of better returns on those risky investments. Researching before investing is crucial these in circumstances.

Secure periods stop capitalists from taking out funds for even more months and years on end. There is also much less openness and governing oversight of personal funds compared to public markets. Investors may struggle to accurately value private properties. When handling risks approved investors require to examine any kind of exclusive investments and the fund managers entailed.

Professional Accredited Investor Secured Investment Opportunities

This adjustment might expand accredited financier status to a series of individuals. Updating the revenue and asset standards for rising cost of living to ensure they reflect changes as time progresses. The current thresholds have remained fixed because 1982. Allowing partners in dedicated connections to integrate their sources for shared qualification as accredited financiers.

Enabling people with certain expert certifications, such as Series 7 or CFA, to qualify as accredited investors. Developing additional demands such as evidence of financial literacy or effectively finishing a recognized investor exam.

On the various other hand, it can also result in skilled capitalists presuming excessive risks that may not be ideal for them. Existing certified capitalists might face enhanced competition for the best financial investment opportunities if the swimming pool expands.

Innovative Accredited Investor Real Estate Deals

Those that are presently considered accredited financiers should remain updated on any type of modifications to the standards and laws. Their eligibility might be based on modifications in the future. To maintain their status as certified capitalists under a modified definition adjustments might be essential in wide range administration tactics. Businesses seeking accredited investors need to stay vigilant regarding these updates to guarantee they are drawing in the appropriate audience of capitalists.

Table of Contents

- – Value Private Placements For Accredited Investors

- – Recommended Accredited Investor Wealth-buildin...

- – High-Performance High Yield Investment Opport...

- – High-Quality Accredited Investor Passive Inco...

- – World-Class Exclusive Investment Platforms F...

- – Professional Accredited Investor Secured Inv...

- – Innovative Accredited Investor Real Estate D...

Latest Posts

Back Tax Land

How To Find Unpaid Property Taxes

Tax Sale Property List

More

Latest Posts

Back Tax Land

How To Find Unpaid Property Taxes

Tax Sale Property List